The UAE News interview by Abdul Basit: The biggest risk to the global economy next year is the depreciation of the US dollar thus creating a ripple in the equity and bond markets, Shan Saeed, Chief Economist, Juwai IQI based in Kuala Lumpur, Malaysia, told The UAE News during an interview while talking about the outlook of US dollar in 2021. Most equity and bond investors don’t really hedge their position against currency risk.

Once the currency risk gets deeper into the markets, it creates disruption and pandemonium in the equity markets. One of the most challenging questions traders has faced over the past 11 years, ever since the Fed’s first QE, has been what is the fair value of stocks without the Fed’s chronic intervention in capital markets via trillions in spontaneously appearing liquidity used to prop up risk assets. As per the calculation, nearly half of the U.S. benchmark’s current level is due to quantitative easing, while claiming that the impact of QE on the Nasdaq was even higher at 57%, with small cap less affected.

The dollar is heading for tail-end risk in the market and might depreciate by 20-40% by Dec 2021. The premise is based on a few variables

1. Low-interest rates till 2023

2. QE will continue till 2023

3. FED wants to keep the dollar low deliberately in order to spur growth

4. Political shenanigans to continue

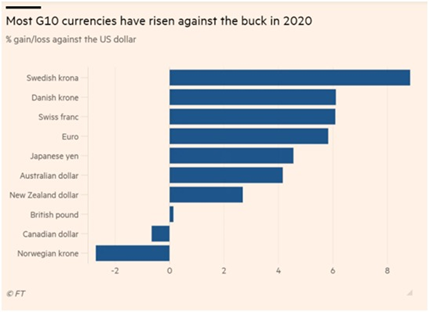

“We shared at the start of the year on Jan 2-2020 Star newspaper; Is the US dollar hegemony over? Currency stability indicates monetary policy levers have worked well for the economy at the macro level. US dollar has lost its value against major currencies in the market.” Major international currencies like Canadian Dollar, Yuan, Yen, Pound Sterling & Swiss Franc will rise by 5-10% in the next 12-18 months.

Money managers and fund managers globally are off-loading their positions in Dollar and going long on Gold. FED is in no more position to get confidence back in the economy. FED has become irrelevant for global investors. The dollar lost 5% of its value in July-2020 alone, while DXY index is down 15% YTD. Debt has touched $27 trillion in the last 11 months [$21 to 27] and the fiscal deficit has reached $4 trillion. The dollar is heading for tail-end risk and is moving towards the south. FED has created two tail-end risks. One is deflation, and the other is inflation. The monetary debasement of the Dollar by the FED will cut the legs of the Dollar in 2021. Get ready as the currency market is getting very volatile in the next two years. – abdulbasit@theuaenews.com