By Abdul Basit

Geopolitical and strategic risks are getting deeper into the energy market. Oil has bounced back from all-time low on April 20 this year when WTI traded at negative $37.63 and Brent at -$26.17.

Demand for crude oil is expected to pick up by third and fourth quarters this year reaching up to 85-90 million barrels per day in line with the global economic recovery, Juwai IQI Global Chief Economist Shan Saeed told The UAE News.

China is leading from the front in terms of economic recovery and registered trade surplus in May 2020. In other parts of the world, demand is lower due to the global lockdown and softening demand in the energy market, as countries ban people from travelling to prevent the COVID-19 outbreak.

According to Shan, it is expected that oil prices to bounce back between US$47 and US$57 per barrel in the next six to nine months on the following:

a) Geopolitical risk China and India. Very delicate situation at the border near Ladakh.

b) The dollar is heading for tail-end risk. QE has not brought confidence back into the economy.

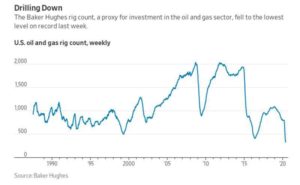

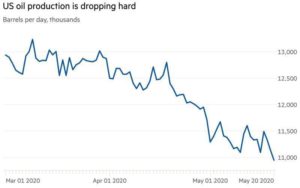

c) Bankruptcies in US shale oil companies would not bring oil production back. Shale gas comatose cannot take the pressure. Bankruptcies amount touched between US$100 billion and US$500 billion in the US energy market.

Shan shared that there are massive selloffs in corporate bonds and lay-offs. Corporate bonds look fragile with US$20 trillion outstanding according to the Economist magazine.

According to Juwai IQI market intelligence report, production cuts are expected from OPEC and OPEC plus will bolster the oil market outlook in the foreseeable future.

Production cuts help stabilise the oil market. Oil demand is going to trade at 102 mbpd by Q-2/2021. The global economy is going to rebound, and most of the energy demand will be coming from Africa and Asia. Asia is the future and going to lead global macro-economic growth. – abdulbasit@theuaenews.com