By Shan Saeed

The UAE News: History teaches us that in times of uncertainty and financial bazooka, park your funds in tangible assets i.e. Real Estate and Gold and Silver.

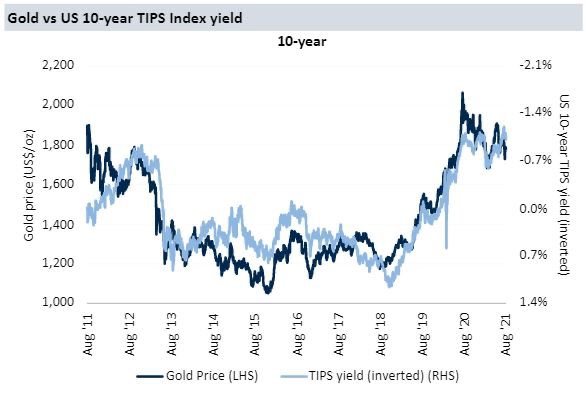

Since last August 2020, when gold touched an all-time high of $2081/oz, it remained subdued and range-bound in the market. It has moved between the $1700/ oz and $1850 / oz range in the last 3 months. Many investors are believing that the Gold chapter is over and let’s go back into the equities asset class where equities are riding all-time high with Price to earning ratio trading above 38. The market cap of US equities has touched $98 trillion as of August 14-2021. However, being a contrarian, I have a different perspective and view the markets differently. In my opinion, four risk factors are going to hit the market some of which have happened already:

- Systematic risk ——Hike in interest rates and higher inflation

- Sovereign bond risk—-$16.3 trillion are trading in negative

- Liquidity risk——Repo and Reverse repo markets have got $7 trillion and 1.2 trillion from FED

- Equity valuation risk —-Equities are running high due to low interest rates and a crazy rush in the market. It would take correction ultimate

MARKET CAP as of August 14, 2021

The global market cap for cryptocurrencies is $1.84 trillion

Global telecommunications market — 5G tech is at $1.74 trillion,

The global food market is valued

at $5 trillion, and

The value of the entire U.S. stock market is $98 trillion.

Sources: Economist/ FT / WSJ

GOLD OUTLOOK — IT CAN SHINE AGAIN

We are heading for 1970s style stagflation and history is repeating itself after 51 years. If history is to repeat and tangible assets i.e. Real Estate and Gold performs as per the market forces, we can expect significant appreciation in tangible asset classes to protect and preserve the wealth of those sophisticated and smart investors. Commodities and land have outperformed all other asset classes.

In the present scenario, this is the third bull run for yellow metals which commenced on Dec 16-2015 when gold prices were trading at $1050/ oz.

Where does gold go from here??? Big question but simple answer. Big four central banks would continue with QE till 2023, keep the low-interest rate regime and above all taper tantrums of bonds will stay behind the scenes. We can foresee Gold moving in the range from $1790 to $2000 / oz. by year-end. Everyone is waiting for Jackson Hole meeting outcomes to be known. Enjoy the volatility and uncertainty in the market. Wealth preservation is extremely important in these tumultuous times.