Web Report

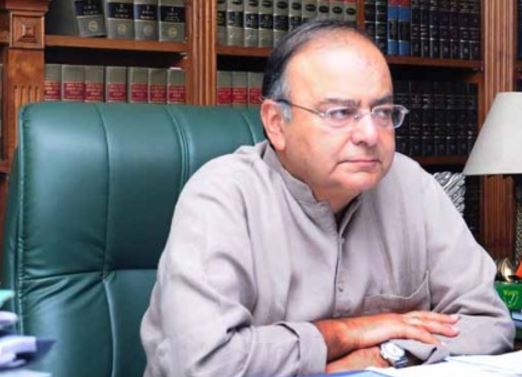

Dubai – It might be a black Friday for Indian businessmen and consumers as the country’s finance minister Arun Jaitley announced four rate bands under a new sales tax for services such as telecoms, insurance and restaurants.

Experts said this move could complicate compliance and leave businesses at the mercy of an intrusive tax bureaucracy.

The Goods and Services Tax (GST), set to be launched from July 1, will have rates of 5, 12, 18 and 28 per cent for services, in line with those applying to goods. It is a big departure from the current regime of a single rate of 15 per cent applied on most services.

It is claimed that the move would make it easier to do business by simplifying the tax structure and compliance. But it is stated that the life will get more complicated for many.

So hotels and restaurant would be taxed on the basis of their room tariff and turnover of business. On the other hand air-conditioned restaurants will even be taxed at a higher rate under the new regime than those without.

Services account for more than half of India’s $2 trillion economy, so the complexities run the risk of derailing the sector’s growth and even slowing Asia’s third-largest economy. The government, however, defended the move, saying different economic classes can’t be taxed at the same rate.

Finance minister Arun Jaitley played down concerns that higher headline rates would inflate the tax burden on consumers. Since service providers will get tax input credits, he said, the effective tax rate will be lower.

“The actual incidence on consumers will go down,” Jaitley told reporters after a two-day meeting.

Healthcare and education services will be tax exempt while services offered at five-star hotels will be taxed at 28 per cent. Telecoms and financial services will be taxed at a standard rate of 18 per cent.

“This is likely to slow down the planned rollout of infrastructure,” said Rajan S. Mathews, director general of the Cellular Operators Association of India.

The long-awaited GST will replace a slew of federal and state levies, seeking to transform a country of 1.3 billion population into a single market.